“I can just buy the QQQs”

“I can just buy the QQQs”

“I can just buy the QQQs”

I was taken aback. Two decades ago I would never have heard an Asian investor utter these words. The ‘Qs’ refer to the ticker of the Nasdaq 100 index Exchange Traded Fund (ETF), one of the best performing investments over the last decade.

The move towards passive investments via ETFs is finally being accepted by Asian investors. In two decades the universe of ETFs has grown tremendously, from less than US$100 billion to the over US$7.7 trillion now. There are now ETFs for almost every sector and country, and it’s far easier to construct a portfolio using them as compared to single stocks. ETFs also offer far more diversification, the only ‘free lunch’ in investing. Sure, you may miss out on the concentration gains of having most of your portfolio in Apple or in Tesla, but you also avoid the disastrous effect of being concentrated in Tencent and Alibaba, both of which lost almost half of its value this year, erasing all gains since 2018.

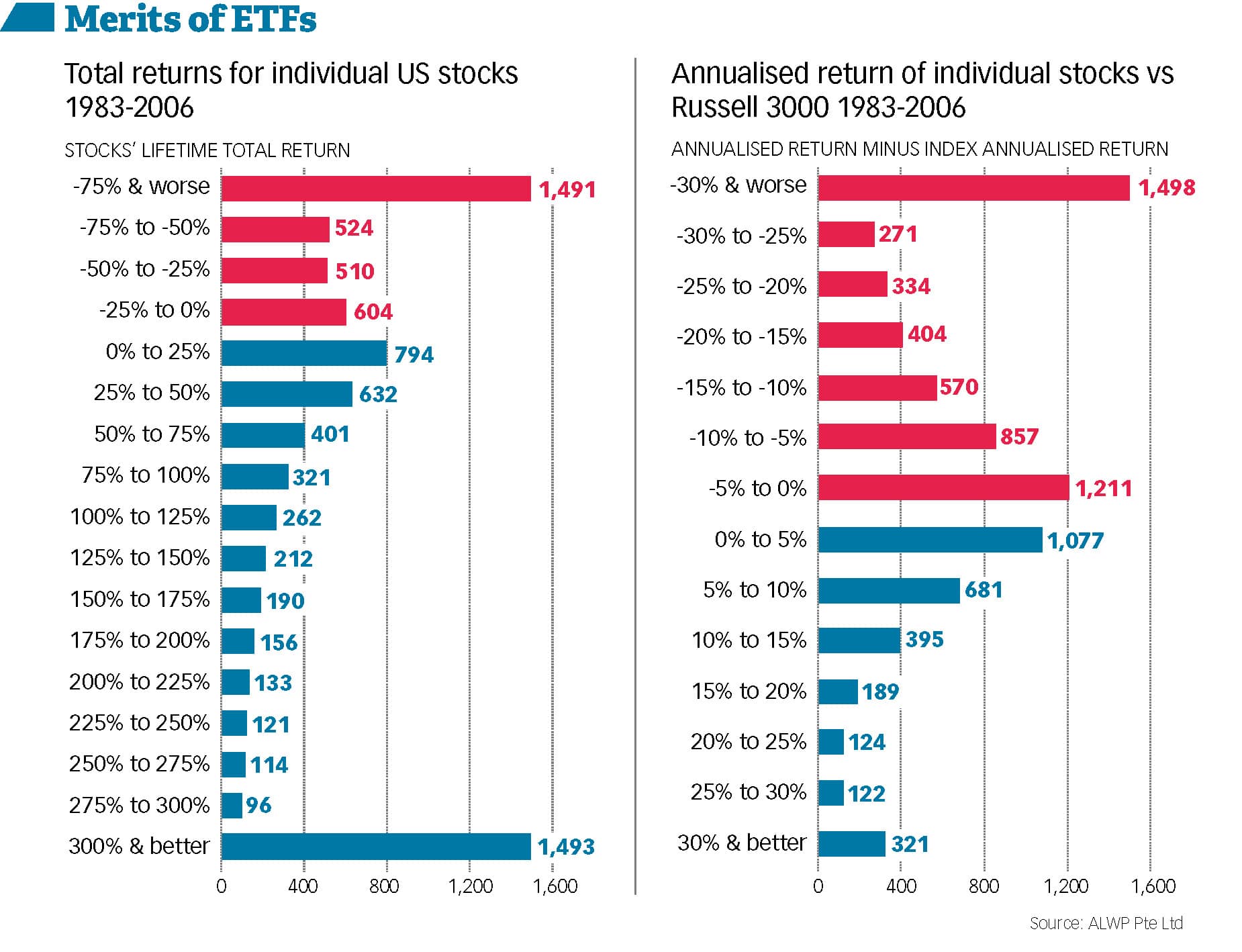

Still believe that picking stocks is the way to go? The chart below, or similar variations, is often used to illustrate the long-term potential for individual stocks. Stocks perform well over time, which can be seen by the distribution being ‘right tailed’, in addition to a significant ‘fat tail’ to the right side, where 1 out of every 5 stocks was a significant winner.

In reality the chart you need to see is the second one, which compares the same stock universe to a broad market index. The Russell 3000 index includes the largest 3000 companies in the US, large companies like Apple, Amazon, and Microsoft, as well as medium sized companies. This chart shows a very different picture. The fat tail on the right (the strong outperformance bar) has disappeared, while the left fat tail (the underperformers) is still there, in order words the worst possible outcome, where investors retain the downside and give up the upside.

18% of all stocks underperform the index by more than 30% per year for over two decades. In other words these stocks persistently underperform by -30% every year for 20 years. As you may have guessed, such a staggering underperformance means that the majority of these stocks go bankrupt, leading to a total loss for investors. On the other side of the coin, only 4% consistently outperform by more than 30% per year. In aggregate, only 14% of all stocks outperform the index by more than 10% per year.

The clear message is that over time there are far more stocks that underperform an ETF than there are stocks that outperform. The number is heavily negatively skewed, so the chances of finding stocks that consistently outperform the index is extremely small.

The reality of the outperformance of stock picking is even more negative than what these two charts suggest. Academic investment research geeks can search online the analysis of a century of stock market returns by Professor Bessembinder. The conclusion is that all of the excess return of stock markets is explained by just 1% of stocks. Owning the other 99% of the stock universe resulted in investors underperforming cash!

Is a century too long a period of analysis? Looking at the last thirty years shows little difference – all the net gains of the stock market since 1990 can be attributed to 2.4% of stocks in the US. Outside of the US, the figures were even worse, with just 1.4% accounting for all returns above cash. This surprising fact is actually hidden in the top chart above, where 39% of all stocks (the red bars) have a negative return.

Still not convinced? Below is the recent performance of a global portfolio made up of just two equity ETFs. We all know that US equities have done tremendously well over the last few years, while Emerging Market equities have performed horribly. To reduce hindsight bias, we create a portfolio that is 50% US (via S&P500 ETF) and 50% EM (via MSCI Emerging Markets ETF). To further handicap the example, we start tracking this in 2018, which was a bad year for equities in general, but particularly bad for EM. The returns below exclude dividends:

2018 -11.73%

2019 +21.83%

2020 +15.65%

2021 October YTD +10.69%

The above portfolio rebalances annually (i.e. resets the allocation at 50% for each ETF) at the beginning of each year, further reducing hindsight bias, because an investor would have been better off just letting the S&P500 run instead of realising the profits to add to EM every year. Half of this portfolio had almost no returns over the period, gaining less than 2% p.a. There is zero market timing and zero stock picking in this portfolio, and yet I’m willing to bet that the above performance compares well to most investors’ portfolios. When including dividends, the actual returns are about 2% p.a. higher.

Are you still picking stocks? ETFs have become the great equaliser. Every investor can now easily create their own portfolio. Even more diversified can also be created, as ETFs are available for other asset classes such as gold and bonds.

I would venture further and say that ETFs have changed the role of wealth managers. The research shows that stock picking is a losers’ game. Actively managed funds in aggregate underperform an index, and this year’s outperformer almost never retains the distinction the following year.

In this environment, the role of your wealth manager should evolve from peddlers of stock picks and structured products to real financial advisors: crafting a proper asset allocation, ensuring that a good financial plan is in place and family needs are taken care of, especially when recessions happen.

The actual investment part? Stop watching CNBC and following stock tips over dinner, use ETFs instead.

By LEONARDO DRAGO

Co-founder of AL Wealth Partners, an independent Singapore-based company providing investment and fund management services to endowments and family offices, and wealth-advisory services to accredited individual investors.